Karelia Jimenez is an Account Manager at PEO Focus, an HR and Employee Benefits Consulting Firm. Fluent in English, Spanish and Portuguese Karelia assists clients with the navigation of identifying which vendors can provide the best experiences for a company and its employees.

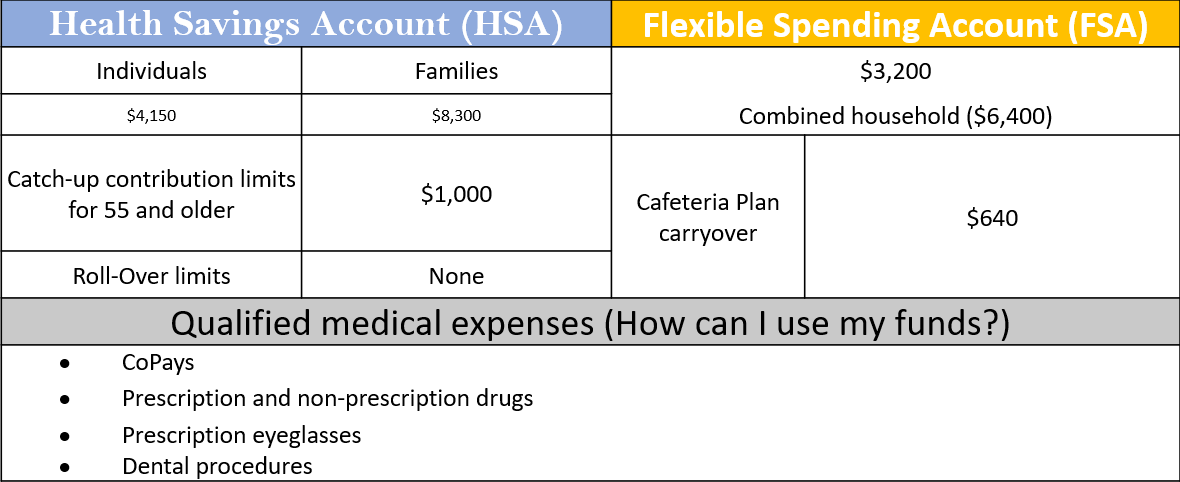

2024 HSA and FSA Limits

New Year New Rules, IRS Releases 2024 HSA and FSA Contribution Limits

The Health and Flexible Spending Accounts Can Offer a

Great Tax Break When Used Properly.

Even though your contribution to any of these accounts are tax-free, there are limits on how much you can contribute to an HSA or FSA each year.

Since these accounts allow users to place money into them tax free, there are penalties that are put in place in the event someone attempts to over contribute.

The IRS just announced medical savings account contribution limits for 2024 and the numbers are around 7% higher than the previous contribution limits for 2023.

2024 HSA and FSA Contribution Eligibility

HSA: You must have a high deductible health plan (HDHP) to open a health savings account.

Medical FSA: Can be paired with Medical Plans other than HDHP Plans.

Limited FSA: Can be used for expenses such as Dental and Vision. Participants in a HDHP Medical Plan are eligible.

There are a few factors to consider:

- HSA and FSA accounts have different rules for Business Owners. click to learn more.

- If you exceed contributions for any (HSA or FSA) the amount will be subject to regular income tax.

- Tax of 6% will also apply to any amount that is over the contribution limit.

Any mistakes made by exceeding the contribution limit can always be corrected if you withdraw the excess funds before the federal tax filing deadline. Interest earned also counts!

About the Author